how much state tax do you pay on a 457 withdrawal

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. 800-352-3671 or 850-488-6800 or.

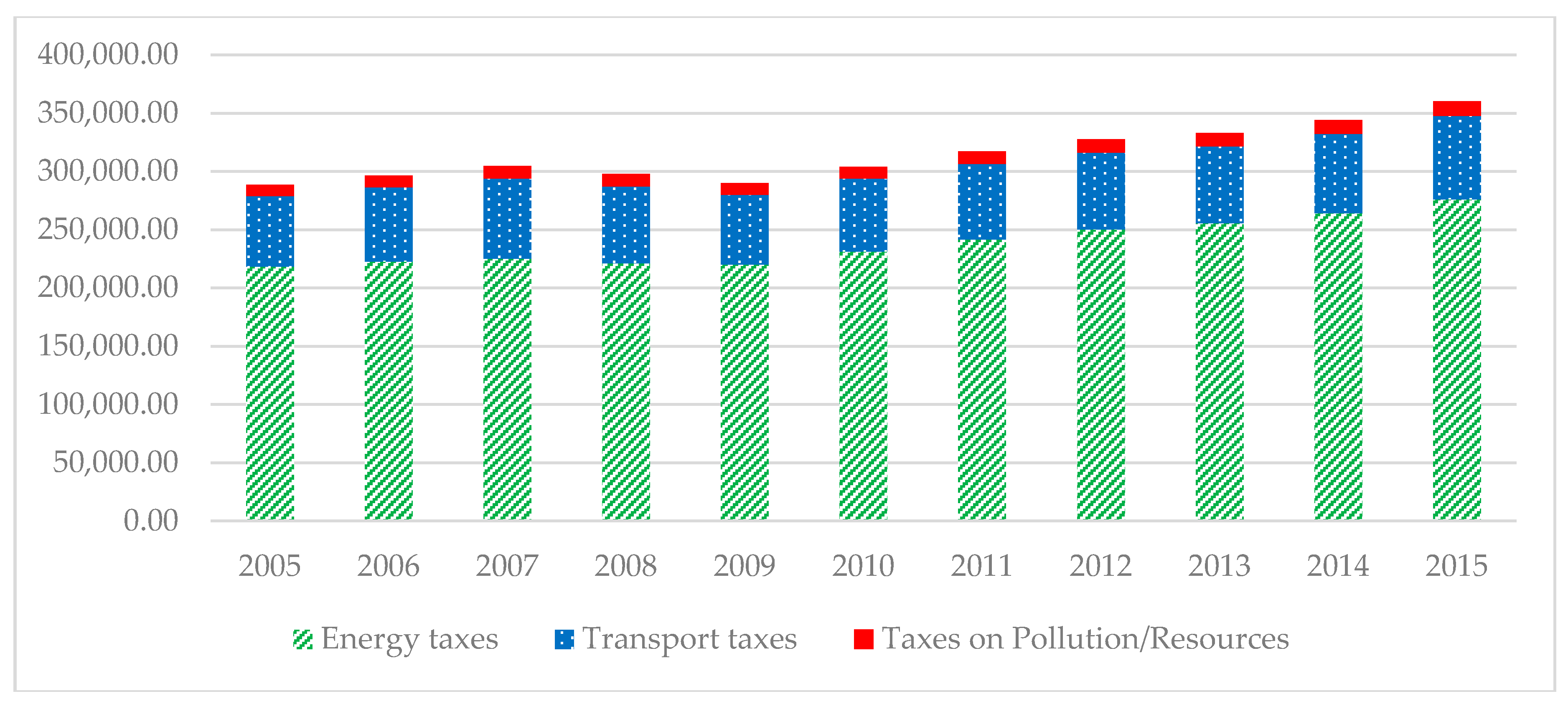

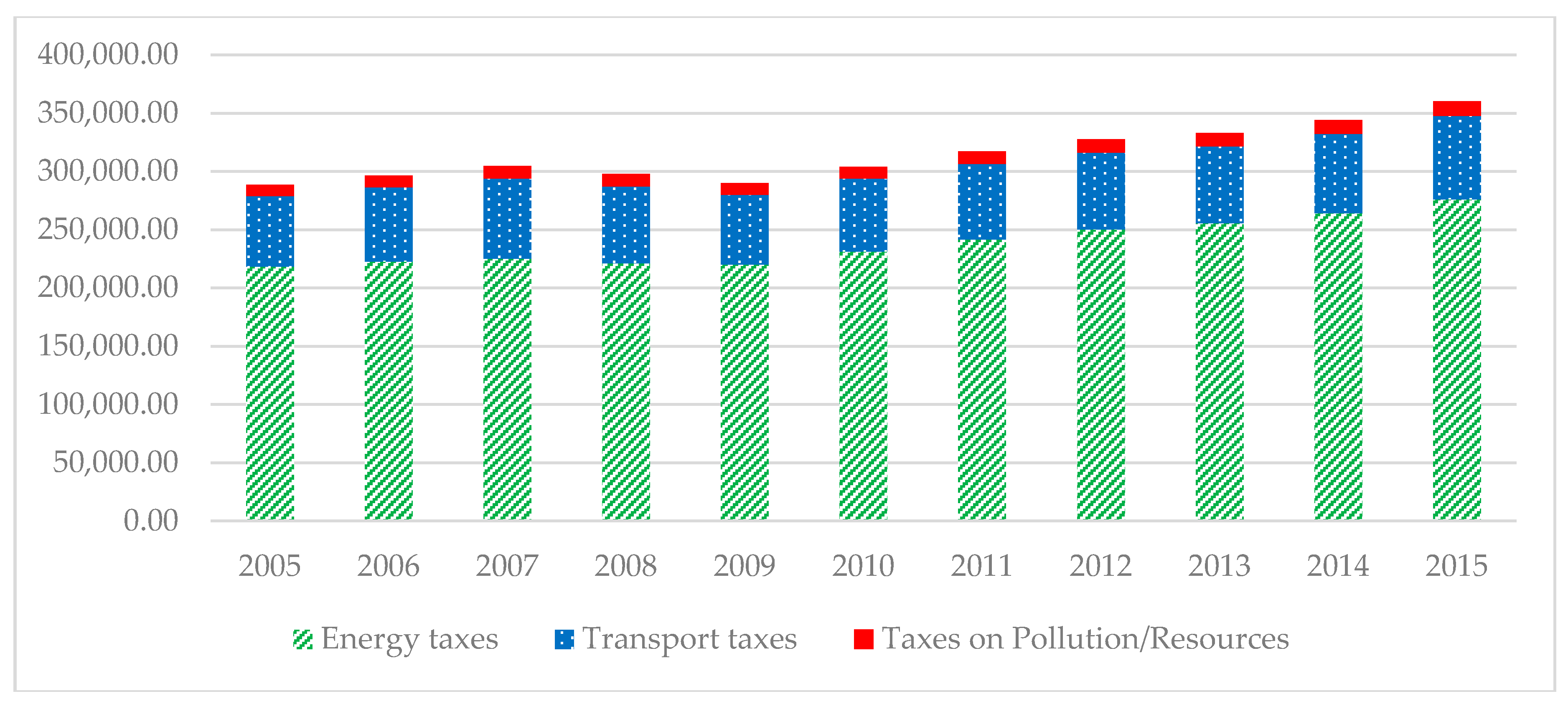

Energies Free Full Text The Impact Of Greening Tax Systems On Sustainable Energy Development In The Baltic States Html

If you have a governmental or non-governmental 457 b plan you can withdraw some or all of your funds upon retirement even if you are not yet 59½.

. 4 percent on taxable income between 10001 and 25000. Because payments received from your 401 k account are considered income and taxed at the federal level you must also pay state income taxes on the. Employers or employees through salary reductions.

You are permitted to withdraw money from your 457 plan without any penalties from the Internal Revenue Service no matter how old you are. It depends what state. The organization must be a state or local government or a tax-exempt organization under IRC 501c.

Your estimated federal tax rate. 6 percent on taxable income between 40001 and. 404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes.

Please note that state taxes are entered in a separate entry field. Your age and employment status. However distributions received after the pensioner turned 59 12 would.

Savings Plus is the name of the voluntary 401 k and 457 b Plans which began in 1974 as a long-term retirement savings program for most State of. Are distributions from a state deferred section 457 compensation plan taxable by New York State. If you do not wait until the age of 59-12 to withdraw your 401 k funds you may pay a penalty tax in addition to federal state and local taxes.

How Withdrawals Work. The current state marginal tax rate you expect to pay on any additional income or taxable distributions. Use the Filing Status and Federal Income Tax.

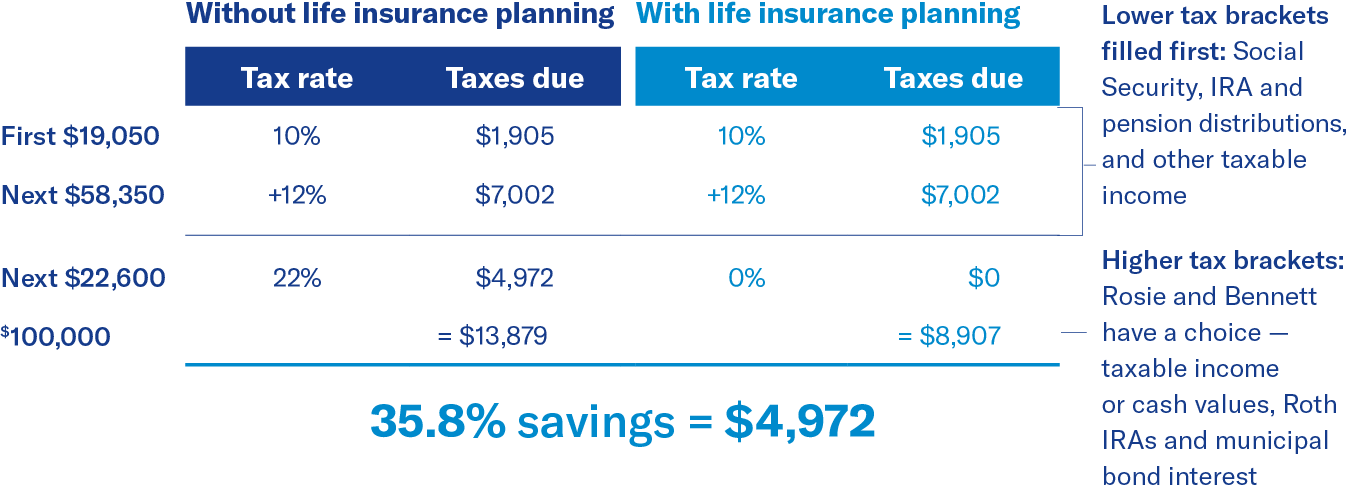

Early distributions those before age 59 12 from 457 b plans are not subject to the 10 percent penalty that 401 k plans are. When you make a withdrawal from a 401k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made. If you take the income now you will pay a 37 tax rate on 100000 of income for a.

How do 457b plans work. For example if you fall in the 12 tax. In most circumstances an early.

Theres a good reason for that Durand says. Your company gives you the opportunity to defer up to 20 of your compensation over a 10-year period. Retirement income exclusion from 35000 to 65000.

A 457b plan is a tax-advantaged retirement plan restricted to state and local public governments and qualifying tax-exempt institutions. A 457b plan is a tax-deferred retirement savings plan that lets you defer part of your wages and save them for retirement. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 planUnlike other tax-deferred retirement plans such as IRAs or. That means you do not pay income taxes when you contribute money. The type of Plan you have 401k or 457.

Amount to withdraw. About Savings Plus. 45 percent on taxable income between 25001 and 40000.

Also how much tax do you pay on a 457 withdrawal. Instead your employer withholds your contribution from your paycheck. 457 Plan Withdrawal Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

Use this calculator to see what your net withdrawal would. However you will have to pay income taxes on the. Unlike 403b and 401k accounts participants can take regular withdrawals from 457 plans as soon as they retire.

A 401k is a tax-deferred account. As with a 401k plan you can get a tax deduction on. Withdrawal Rules for a 457b Account.

If you are unsure the calculator will choose 25. However if you withdraw from. 457 Plan Withdrawal Calculator Definitions.

Basically any amount you withdraw from your 401k account has taxes withheld at 20 and if youre under. So if you have the option of a 401 k and a 457 and youre under the age of 50 you can contribute up to 38000 a year between the two plans.

One Of The Best Ways To Increase Your Savings Is To Spend Less Even A Simple Chan Mortgage Amortization Calculator Savings Calculator Mortgage Loan Calculator

Tax Expenditures Reporting In Developing Countries An Evaluation Cairn International Edition

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

Tax Expenditures Reporting In Developing Countries An Evaluation Cairn International Edition

Pension Fund Tax Deferred Retirement Account 403 B Roth 403 B

Tax Expenditures Reporting In Developing Countries An Evaluation Cairn International Edition

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

Tax Expenditures Reporting In Developing Countries An Evaluation Cairn International Edition

What Is The Security Transaction Tax When Is Stt Levied Scripbox

Tax Expenditures Reporting In Developing Countries An Evaluation Cairn International Edition

Should Physicians Use 457 B As A Tax Saving Vehicle

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Traditional Ira

Tax Expenditures Reporting In Developing Countries An Evaluation Cairn International Edition

Tax Expenditures Reporting In Developing Countries An Evaluation Cairn International Edition

A Guide To 457 B Retirement Plans Smartasset

Regressive Tax Examples Different Examples With Explanation

Can You Withdraw From Retirement Accounts For Education Disabilities Health Care Financial Planning Retirement Accounts College Expenses How To Plan